In the annals of modern cinema, few films have managed to make as significant an impact while delving into the complex and often convoluted world of high finance as “The Big Short.” This gripping movie, based on the best-selling book by Michael Lewis, takes viewers on a rollercoaster ride through the events leading up to the 2008 global financial crisis. It not only entertains but also educates, shedding light on the inner workings of Wall Street and the systemic failures that brought the economy to its knees. Let’s dissect this cinematic masterpiece to understand what it’s truly about.

The Premise: A Financial House of Cards

The Housing Bubble Build-Up

At the heart of “The Big Short” lies the explosive growth of the American housing market in the early 2000s. Home prices skyrocketed, fueled by lax lending standards and the widespread belief that housing was a fail-safe investment. Banks and mortgage lenders were churning out mortgages at an unprecedented rate, often to borrowers with little to no creditworthiness. These were the so-called subprime borrowers, people with unstable incomes, poor credit histories, or both. Lenders were willing to overlook these red flags because they could package these mortgages into complex financial products and sell them off to investors, seemingly passing on the risk.

The Birth of Toxic Assets

This led to the creation of what would become known as toxic assets. Mortgage-backed securities (MBS), collateralized debt obligations (CDOs), and credit default swaps (CDSs) were the financial instruments at the center of the storm. Mortgage-backed securities were bundles of mortgages that were sold as investments. CDOs took it a step further, slicing and dicing these MBS and other debts into different tranches, each with its own supposed level of risk and return. Credit default swaps were essentially insurance policies against the default of these assets. However, the problem was that the true risks associated with these products were massively underestimated, and in many cases, deliberately obfuscated.

The Protagonists: Mavericks Who Saw It Coming

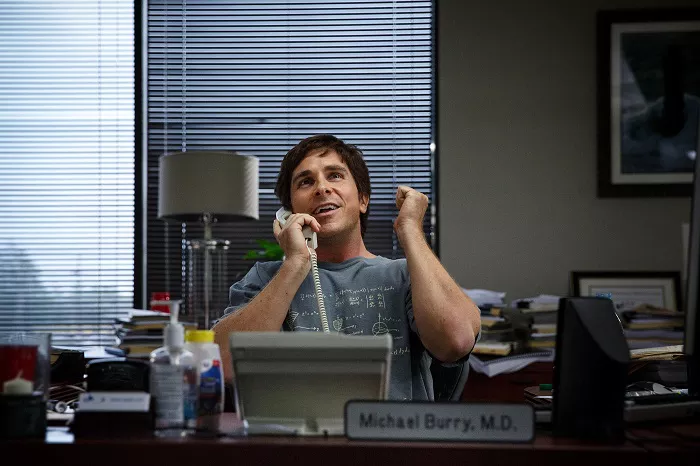

Michael Burry: The Eccentric Visionary

Enter Michael Burry, a brilliant but socially awkward hedge fund manager. Played by Christian Bale, Burry was an outlier in the financial world. His Asperger’s-like traits made him seem detached and unapproachable, but they also gave him a unique ability to focus intently on data and patterns. In 2005, Burry noticed the cracks in the subprime mortgage system. After months of painstaking research, poring over mortgage filings and analyzing trends, he made a bold move. He decided to bet against the housing market by purchasing credit default swaps. This was an unheard-of strategy at the time, and his investors, along with the broader financial community, thought he had lost his mind. But Burry was convinced he was right, and he stuck to his guns, even as the pressure mounted.

Mark Baum and His Team: The Righteous Investigators

Mark Baum, based on real-life investor Steve Eisman, led a team of investors at FrontPoint Partners. Initially skeptical of the housing bubble claims, Baum and his colleagues embarked on a journey of discovery. They visited subprime lenders and witnessed firsthand the irresponsible lending practices. They saw borrowers with no income verification being approved for mortgages, and loans being given out based on inflated property appraisals. This eye-opening experience transformed them from doubters to believers in the impending collapse. Their moral outrage and determination to expose the truth added a powerful human element to the story. They too decided to take positions against the housing market, not just for financial gain but also to hold the industry accountable.

Jared Vennett: The Street-Smart Catalyst

Jared Vennett, played by Ryan Gosling, was inspired by Greg Lippmann, a Deutsche Bank trader. Vennett was the smooth-talking, somewhat cynical character who served as a bridge between the complex financial jargon and the audience. He recognized the opportunity presented by the housing market collapse early on and was eager to profit from it. He approached Michael Burry and Mark Baum’s teams, introducing them to the concept of credit default swaps and the potential windfall that could come from betting against the housing market. His role was crucial in connecting the dots and getting the ball rolling. He was the one who helped make the idea of shorting the housing market seem accessible and appealing to others in the financial world.

The Unraveling: As the Crisis Looms

The Doubts and Pressures

As the months passed and the housing market continued to show signs of overheating, our protagonists faced mounting doubts and pressures. Michael Burry’s investors grew increasingly restless, demanding that he reverse his bet. They couldn’t fathom why he was seemingly throwing away their money on what they believed was a losing proposition. Mark Baum’s team also had their internal struggles. While they were convinced of the impending doom, they were constantly second-guessing themselves. The enormity of what they were predicting and the potential consequences for the global economy weighed heavily on them. And Jared Vennett, for all his bravado, had to navigate the cutthroat world of Wall Street, where backstabbing and self-interest were the norm.

The Signs of the Imminent Collapse

Despite the doubts, the signs of the coming collapse were becoming impossible to ignore. Foreclosures started to spike, and the delinquency rates on subprime mortgages soared. Banks that had been so eager to issue mortgages were now realizing the full extent of the problem. But it was too late. The complex web of financial instruments they had created had spread the risk far and wide, not just across the United States but globally. As the housing market began to crumble, the value of mortgage-backed securities and CDOs plummeted, triggering a chain reaction. Credit default swaps, which were supposed to provide protection, now became a liability as the issuers couldn’t cover the losses.

The Fallout: A World in Turmoil

The Global Economic Impact

The collapse of the housing market and the subsequent implosion of the financial system had far-reaching consequences. Unemployment skyrocketed as businesses folded, unable to secure credit or facing a sudden drop in demand. Major financial institutions, once thought to be invincible, like Lehman Brothers, collapsed, sending shockwaves through the global economy. Governments around the world were forced to step in with massive bailouts to try and stabilize the financial system. Taxpayers were left footing the bill, while many of the bankers and investors who had caused the mess walked away relatively unscathed, at least in the short term.

The Moral and Social Reckoning

“The Big Short” also forces viewers to confront the moral and social implications of the crisis. It shows the greed and short-sightedness that pervaded Wall Street. The bankers and investors were more concerned with lining their pockets than with the long-term health of the economy. Credit rating agencies, which were supposed to act as gatekeepers, failed miserably, giving top ratings to risky assets because they were paid by the very banks that created them. The film makes us question the fairness of a system where the few can profit at the expense of the many, and where the consequences of their actions are borne by ordinary people. It’s a call to action, urging us to demand more transparency and accountability in the financial world.

Conclusion

In conclusion, “The Big Short” is a movie that goes beyond entertainment. It’s a cautionary tale that uses the power of cinema to bring to life the events leading up to the 2008 financial crisis. It shows us the human faces behind the numbers, the maverick investors who dared to go against the grain, and the systemic failures that led to a global meltdown. Whether you’re a finance novice or an industry veteran, this film has something to offer. It educates, it provokes thought, and it leaves you with a deeper understanding of the forces that shape our economic lives. As we watch it, we’re not just seeing a movie; we’re witnessing a history lesson, a moral indictment, and a call to arms for a more responsible financial future.

Related topics

What Movie Is Similar to the Big Short?

Is Tom Cruise in the Big Short?

Is The New Joker Movie A Musical?